Title

In 1998, WRI and WBCSD formed a partnership to develop the Greenhouse Gas (GHG) Protocol Corporate Standard, published in 2001 and revised in 2004, and the GHG Protocol for Project Accounting (Project Protocol), published in 2005. These standards provide two methods to account for emissions, respectively: entity-level GHG inventory accounting, which describes how to quantify and allocate an organization’s share of emissions to the atmosphere, and project-based GHG accounting, which describes how to evaluate emissions effects of a project relative to a counterfactual baseline scenario without the project.

Inventory accounting, as outlined in the Corporate Standard, is widely used by companies and organizations around the world to report emissions. It provides the foundation for target- and goal-setting programs (e.g., Science-based Targets initiative) and mandatory climate disclosure rules (e.g., European Sustainability Reporting Standards, California Climate Corporate Data Accountability Act, US SEC proposed climate disclosure rule, etc.). These programs and mandates have resulted in incentives for entities to reduce emissions within their inventory.

Project-based accounting is used widely by carbon market programs to quantify project-level GHG reductions and removals. The Project Protocol and other project-level methods can also be used for companies to understand and report the GHG impacts of individual projects or actions. Stakeholder feedback via GHG Protocol’s current standards update process has suggested that project-based accounting does not currently play a meaningful role in organization-level target- and goal-setting programs or disclosures that rely primarily on corporate inventories. However, there is increasing interest in accounting for projects and actions that are perceived to have an overall benefit on the climate and in having these actions included in corporate GHG reporting to incentivize these actions. The use of these two methods together has emerged as a key area of stakeholder interest within the context of GHG Protocol’s standards update process. To provide background context for stakeholder discussions on how project accounting could be used within GHG reporting, below we summarize these two methods based on published GHG Protocol standards and their suggested appropriate uses.

Inventory accounting, also known as attributional accounting, tracks GHG emissions and removals within a defined organizational and operational boundary over time. It is the primary method used by corporations and other organizations to report emissions from their operations and value chains. Its rules and procedures are detailed within several GHG Protocol standards and guidance including the GHG Protocol Corporate Standard, the Scope 2 Guidance, the Corporate Value Chain (Scope 3) Standard, and the upcoming Land Sector and Removals Guidance. The inventory accounting approach requires reporting organizations to define clear organizational and operational boundaries, within which emissions are quantified and organized across scopes 1, 2, and 3. The GHG Protocol standards and guidance documents also delineate cases in which emissions, such as biogenic CO2 emissions, shall be reported outside the scopes.

From the GHG Protocol Corporate Standard:

"Business operations vary in their legal and organizational structures […]. In setting organizational boundaries, a company selects an approach for consolidating GHG emissions and then consistently applies the selected approach to define those businesses and operations that constitute the company for the purpose of accounting and reporting GHG emissions." (page 16)

"The GHG Protocol Corporate Standard focuses on accounting and reporting for GHG emissions at the company or organizational level. Reductions in corporate emissions are calculated by comparing changes in the company’s actual emissions inventory over time relative to a base year. Focusing on overall corporate or organizational level emissions has the advantage of helping companies manage their aggregate GHG risks and opportunities more effectively. It also helps focus resources on activities that result in the most cost effective GHG reductions." (page 59)

Project-based accounting, also known as consequential accounting or intervention accounting, estimates the impacts or changes in GHG emissions resulting from specific projects, actions, or interventions relative to a counterfactual baseline scenario. It is the primary method used to evaluate the emission effects of projects by comparing emissions and removals that happen in the project scenario with an estimate of what would have happened without the intervention. The project-based accounting approach evaluates system-wide emissions impacts of the project or intervention in question, without regard to the reporting company’s operational or organizational inventory boundary. Its rules and procedures have been detailed in the GHG Protocol for Project Accounting, its sector-specific supplements such as the Guidelines for Quantifying GHG Reductions from Grid-Connected Electricity Projects, the Land Use, Land-Use Change, and Forestry (LULUCF) Guidance for GHG Project Accounting, and other resources listed at the end of this document.

From the GHG Protocol for Project Accounting:

"The GHG assessment boundary encompasses all primary effects and significant secondary effects associated with the GHG project. Where the GHG project involves more than one project activity, the primary and significant secondary effects from all project activities are included in the GHG assessment boundary. The GHG assessment boundary is used to identify the GHG sources and sinks that must be examined to quantify a project’s GHG reductions. It is not a physical or legal “project boundary.” Primary and significant secondary effects are considered within the GHG assessment boundary, irrespective of whether they occur near the project, or at GHG sources or sinks owned or controlled by the project participants. Under the Project Protocol, it is not necessary to define a project boundary based on a GHG project’s physical dimensions or according to what is owned or controlled." (page 12)

"The GHG assessment boundary encompasses GHG effects, regardless of where they occur and who has control over the GHG sources or sinks associated with them. This inclusive GHG assessment boundary is intended to encourage a more comprehensive assessment of the GHG project’s effect on GHG emissions and to minimize the possibility of overlooking any significant GHG effects that may occur outside the project’s physical location or beyond the control of the project developer." (page 29)

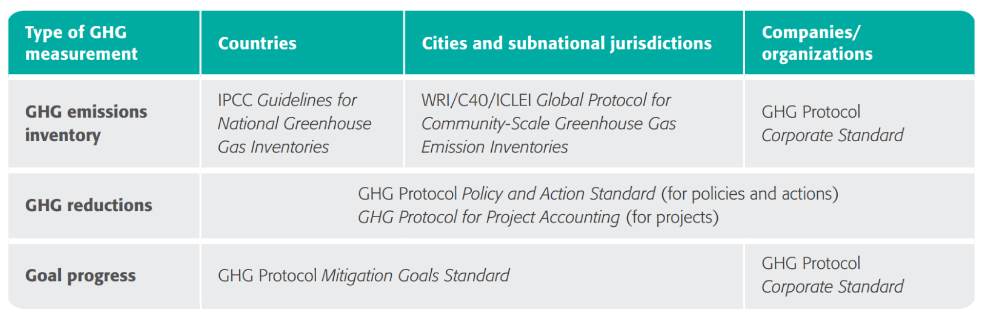

Building on the Project Protocol, the GHG Protocol developed the Policy and Action Standard in 2014, which follows the same basic methodology to estimate impact but applies to actions at a larger scale than an individual project. Table 1 summarizes different types of GHG measurement.

Table 1. Types of GHG measurement and associated standards or guidelines at multiple levels

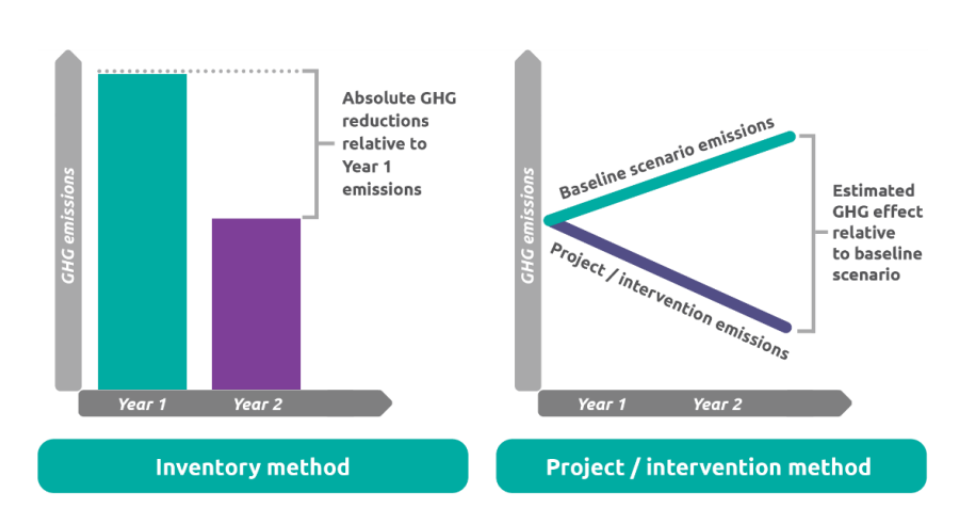

Key differences: Two of the important distinctions between inventory and project accounting are (1) the assessment boundary and (2) the reliance on observed data vs. counterfactual scenarios. Whereas the inventory accounting approach uses boundaries defined by emissions sources owned or controlled by the reporting organization and in the company’s value chain, the project accounting approach identifies all potential primary and secondary impacts of the project in question and assesses the GHG emission increases or reductions from the baseline relative to the project activity. For this reason, inventory accounting approaches quantify direct emissions that have occurred, and thus theoretically all direct (scope 1) emissions values could be summed within a defined geographical or political region to equal total emissions of that region if there were complete reporting. Inventory accounting, however, does not quantify impacts of an organization’s individual actions. By contrast, project accounting provides a holistic view of the impacts of a specific intervention relative to what would have otherwise occurred, including the system-wide impacts beyond the GHG inventory boundary. However, project accounting does not allocate total system emissions or removals that have occurred, nor does it provide a comprehensive quantification of all an organization’s emissions. Figure 1 helps illustrate how each approach can be used to assess emissions or emissions impacts over time.

Figure 1. Comparison of inventory and project/intervention accounting methods

To illustrate these key differences, consider a company that wishes to understand the GHG emissions implications of installing a behind-the-meter rooftop solar photovoltaic (solar PV) system:

- Using inventory accounting, the company would first calculate their scope 2 emissions associated with their total purchased electricity as part of their GHG inventory before installing the rooftop solar PV. After the rooftop solar PV is operational, they would continue to account for the scope 2 emissions associated with their purchased electricity, now a lower amount as they generate their own [emission-free] electricity. Since the inventory approach requires defining an inventory boundary and allocating emissions or removals that have occurred, the changes to their scope 2 emissions (i.e., their reduced electricity consumption from the grid) and scope 3 emissions (i.e., the embodied life cycle emissions of the solar PV panels) corresponds to an allocated share of emissions emitted to the atmosphere.

- Using project accounting, the company would estimate the changes between a counterfactual baseline scenario where the company installs no onsite solar generation (i.e., an estimate of what would have happened without the intervention) and actual system-wide emissions with installation of the onsite solar PV (i.e., the emissions that happen in the project scenario) as the “GHG effects”. In this example the “primary effect” would be the estimated marginal reduction of other grid-connected power plants, often powered by fossil fuels. Such differences are frequently called “avoided emissions”.

The Scope 2 Guidance provides additional clarity on these distinctions as well as addresses the importance of a clear separation between inventory and project accounting concepts. Critically, this includes requirements that any reporting of avoided emissions estimated with project-based accounting methods are disclosed separately from scope 2 inventory accounting totals.

From the Scope 2 Guidance:

"Companies can report the estimated grid emissions avoided by low-carbon energy generation and use, separately from the scopes. This type of analysis reflects the impacts of generation on the rest of the grid: for example, the emissions from fossil-fuel or other generation backed down or avoided due to the low-carbon generation. These avoided emissions estimations inherently represent impacts outside the inventory boundary. Avoided emissions estimations are not necessarily equivalent to global emissions reductions from additional projects and should therefore not be used to reduce a company’s footprint. However, quantifying avoided emissions provide several technical and strategic benefits, including:

-Identifying where low-carbon energy generation can have the biggest GHG impact on system, based on the operating margin.

-Demonstrating that grid-connected generation provides a system-wide service in addition to conveying a specific emission rate at the point of production.

This estimation should follow project-level methodology; see GHG Protocol Project Protocol or Guidelines for Grid-Connected Electricity Projects. This may be most beneficial where a company has taken actions that avoid higher carbon generation dispatch at the margins." (page 52)

In sum, the above example emphasizes that each approach provides a credible method of assessing GHG emissions or emissions impacts, but they are based on fundamentally different accounting principles, lead to distinct output information and serve different purposes. The GHG Protocol Corporate Standard addresses some of these nuances in using either the inventory or project accounting methods.

From the GHG Protocol Corporate Standard:

"When companies implement internal projects that reduce GHGs from their operations, the resulting reductions are usually captured in their inventory’s boundaries. These reductions need not be reported separately unless they are sold, traded externally, or otherwise used as an offset or credit. However, some companies may be able to make changes to their own operations that result in GHG emissions changes at sources not included in their own inventory boundary, or not captured by comparing emissions changes over time. For example: Substituting fossil fuel with waste-derived fuel that might otherwise be used as landfill or incinerated without energy recovery. Such substitution may have no direct effect on (or may even increase) a company’s own GHG emissions. However, it could result in emissions reductions elsewhere by another organization, e.g., through avoiding landfill gas and fossil fuel use.” (page 61)

Project accounting enables sustainability professionals to consider system-wide impacts of interventions or projects and pursue those that go beyond reducing their own GHG emissions inventories to reduce emissions across an entire system. That said, care must be taken when using this approach to ensure impacts are quantified accurately and in the right context. Because of the inherent differences between inventory and project accounting, the GHG Protocol has suggested entities use both methods but limit the usage of each method for specific goals.

From the GHG Protocol for Project Accounting:

“The Project Protocol is written for project developers, but should also be of interest to administrators or designers of initiatives, systems, and programs that incorporate GHG projects, as well as third-party verifiers for such programs and projects. Any entity seeking to quantify GHG reductions resulting from projects may use the Project Protocol. However, it is not designed to be used as a mechanism to quantify corporate or entity-wide GHG reductions; the Corporate Accounting Standard should be used for that purpose.” (page 5)

“A company can use both GHG Protocol Initiative modules in combination to meet different purposes and objectives. Where a company is developing an inventory of its corporate-wide GHG emissions, the Corporate Accounting Standard can be used. If the same company develops a GHG project, then the Project Protocol can be used to quantify its project-based GHG reductions.” (page 8)

Throughout both the GHG Protocol Corporate Standard and Project Protocol, there is a clear recognition of the value these two fundamental accounting methods provide to organizations in evaluating their decarbonization strategies. Companies should generate and use both types of information to inform decision-making. Development of additional guidance on the use of each method within target- and goal-setting programs as well as mandatory climate disclosures may be beneficial for applying these concepts to real world projects and strategies.

References

|